Analog Devices, Inc. (ADI) has firmly established itself as a leader in the high-performance analog technology sector, specializing in data conversion, signal processing, and power management technologies. This comprehensive analysis explores ADI's financial strength, strategic initiatives, innovative product offerings, and competitive positioning, particularly against Texas Instruments (TI), to demonstrate why Analog Devices represents a promising investment with a recommended price target of $200 per share.

Analog Devices boasts a robust financial performance characterized by steady revenue growth, a testament to its diversified product portfolio and strong market demand across various industries, including automotive, communications, and industrial. ADI's strategic acquisitions, most notably the acquisition of Maxim Integrated, have further solidified its market position and expanded its technological capabilities. The company's commitment to R&D investment ensures continual innovation and leadership in high-performance analog, mixed-signal, and digital signal processing (DSP) technologies. A solid balance sheet and commitment to shareholder returns, through dividends and share buybacks, underscore ADI's financial health and growth prospects.

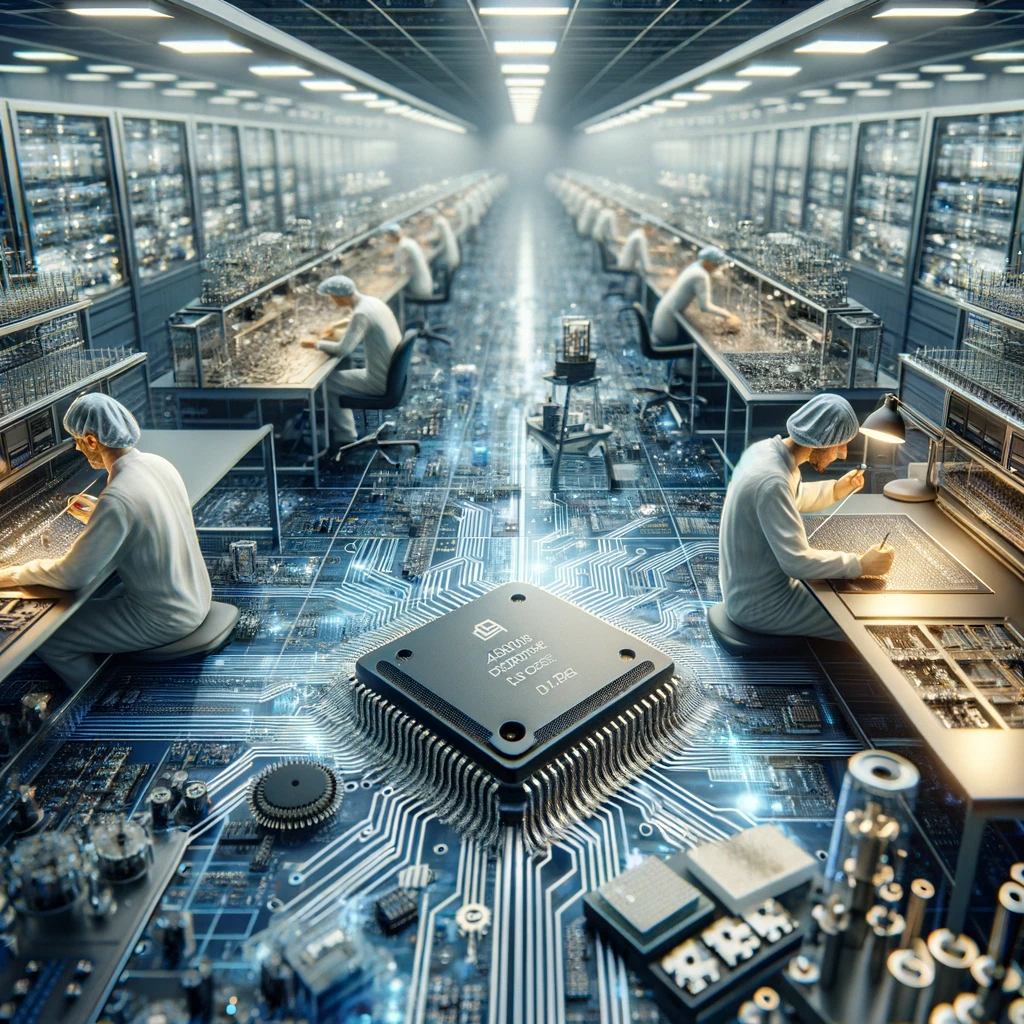

ADI's success stems from its strategic focus on designing and manufacturing semiconductor products that lie at the heart of solving the most complex engineering challenges.

ADI's leadership in data conversion and signal processing technologies enables the conversion of real-world phenomena into actionable insights, powering advancements in automation, electrification, digital health, and connectivity. The company's products are critical for applications requiring precise measurement, robust connectivity, and efficient power management, making them indispensable in today's increasingly digital and interconnected world.

The acquisition of Maxim Integrated complements ADI's product portfolio, especially in automotive and data center markets, and enhances its scale and capabilities. This strategic move not only broadens ADI's technological offerings but also strengthens its competitive positioning and access to new markets.

When compared to Texas Instruments, another giant in the analog semiconductor space, ADI's focus on high-performance analog components and integrated solutions for signal processing applications distinguishes it. While TI has a broader product range and a significant presence in markets such as education and consumer electronics, ADI's deep technical expertise, and focus on niche, high-margin applications provide it with a competitive edge in sectors requiring high precision and reliability.

The semiconductor industry is characterized by rapid technological advancements, cyclical demand, and intense competition. ADI faces challenges such as supply chain disruptions and evolving market needs. However, the company's strong R&D capabilities, strategic acquisitions, and focus on innovation position it well to capitalize on significant growth opportunities in emerging technologies like 5G, IoT, and autonomous vehicles.

Analog Devices' combination of financial strength, strategic market positioning, and commitment to innovation in high-performance analog technology positions it as a compelling investment opportunity. The company's expertise in engineering critical semiconductor technologies, combined with its strategic initiatives to expand its product portfolio and market reach, underscores its potential for sustained growth. With a recommended price target of $200 per share, Analog Devices is poised to continue its trajectory of success, offering investors a strategic stake in a leader driving the future of analog technology.